Legal Alert: Keys tu understanding the application of VAT/GST to digital services in Chile

July 9, 2020 / By Rodrigo Álvarez, Germán Vargas y Gonzalo Zegers

Law Nº 21.210, which Modernized our Tax Legislation, was published in the Official Gazette on February 24th, 2020. This law strengthened the process of technological and digital transformation of the Chilean Tax Authority (hereafter “Servicio de Impuestos Internos” or “SII”). This process is aimed at providing tools that enable the SII to exercise the powers and faculties established by law, especially since the aforementioned Law levied some digital services with VAT. This regulation came into full force on June 1st, 2020.

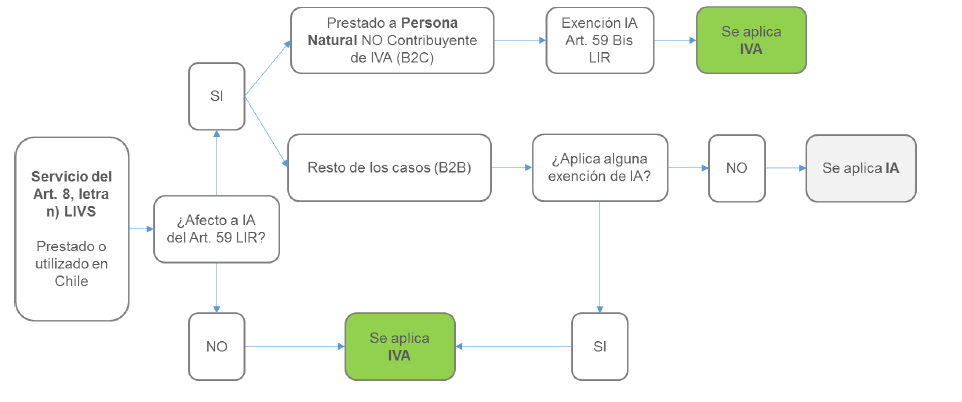

As we mentioned, not all digital services are subject to VAT, some will be subject to Withholding Tax (“WHT”) and exempt from VAT and vice-versa.

These are the main questions surrounding the new tax:

What digital services are subject to VAT?

The following remunerated services rendered in Chile by non-domiciled, non-resident providers, are subject to VAT:

- The intermediation of services rendered in Chile, of whatever nature, or of sales made in Chile or abroad, if the latter results in an import.

- The supply or delivery of digital entertainment content, such as videos, music, games or other analogue content, through downloading, streaming or other technologies, texts, magazines, newspapers and books, including for these purposes.

- The provision of software, storage, computing platforms or digital infrastructure.

This category features:

- Software as a Service (“SaaS”): Rendered mainly to the end user. These services are provided through applications that run on the provider’s cloud infrastructure, which the user can access through various devices such as a web browser or cell phone.

- Platform as a Service (“PaaS”): Aimed mainly to app developers, who are given the tools (through a platform or cloud infrastructure) to build, compile and run their programs.

- Infrastructure as a Service (“IaaS”): Similar to PaaS but with fewer resources offered, allows the client to rent separate service components (mainly servers, storage, networking and data centers). Users will be responsible for handling other resources such as runtime, middleware and O/S.

4. Advertising, regardless of the medium or means through which it is delivered, materialized or executed.

According to the VAT Law (“VATL”), VAT applies when services are rendered or used in Chile, regardless of whether the payment is made in Chile or abroad. Thus, it is understood that a service is rendered in Chile when the activity that generates the service is developed in Chile, regardless of the place where it is used.

Whereas, for the services used in Chile, the VATL establishes a special rule, by which it presumes that a service is used in Chile, when at least two of the following situations concur:

i. That the IP address of the user’s device or other geolocation mechanism indicates that they are located in Chile;

ii. That the card, bank account or other means of payment used for payment of the service, are issued or registered in Chile;

iii. That the billing address of the user or the place of issuance of invoices is located in Chile; or,

iv. That the subscriber identity module (SIM) card of the mobile telephone used to receive the service has Chile as its country code.

Therefore, if any two of the situations described above are met, the VATL presumes that the service is used in Chile and, consequently, subject to VAT.

What is the taxable event and its rate?

The VAT/GST rate is 19% and it is added to the compensation received by the providers for their services, regardless of the name given to that payment (whether it is “service authorization”, “service fee”, “application fee” or “access fee”, “charge”, etc.).

Will the non-resident companies have to comply with the Chilean VAT regulation?

No. Foreign entities will not be entitled to tax credit and will be released from the obligation to issue tax documents (invoices) for their operations.

Who has to declare and pay the VAT?

The general rule is that the supplier of the service must declare and pay the VAT. However, if the beneficiary of the service is a VAT-payer under the VATL, they will be responsible for declaring and paying the tax and not the non-resident provider.

Below you will find the diagram presented by the SII in Ruling No. 42 dated June 11th, 2020, to illustrate this:

| Contacts |

| For more information, please contact: |

| Rodrigo Álvarez Partner ralvarez@dlapiper.clGermán Vargas Senior associate gvargas@dlapiper.cl |

* This report provides general information on certain legal or commercial matters in Chile, and it is not intended to analyze in detail the matters contained in it, nor it is intended to provide a particular legal advice on them. It is suggested to the reader to look for legal assistance before making a decision regarding the matters contained in this report. This report cannot be reproduced by any means or in any part, without the prior consent of DLA Piper BAZ | NLD SpA. (c) DLA Piper BAZ | NLD SpA 2020.